Insurance can help protect the things you love and the people who depend on you. However, it is important to understand how policies work before making a purchase.

For example, term life offers death benefits only for a set period of time, while whole life policies build cash value. And indexed universal policies earn interest based on market indexes.

Health Insurance

Health Insurance is a must have as it helps you connect to a medical expert at a time of need, gives cashless claim facility and protects your savings from the financial repercussions caused due to accidents and illnesses. Also, it provides tax benefits under Section 80D of the Income Tax Act.

Usually, you can buy health insurance by paying a small premium. Many insurers offer a short-term policy for students or those who are between jobs. These plans are often cheaper and simpler than COBRA.

You must never ignore the terms and conditions mentioned in your health insurance policy document. Whether it’s the coverage limit, premium costs, renewal condition, discounts, free-look period, sub-limits or waiting periods, every detail is written in clear language.

One of the important things you must keep in mind is that your policy should cover Essential Health Benefits, which are a minimum set of health services. California law requires most health insurance policies to cover these EHBs, but not all do. Check the summary of benefits on your health insurance card.

Life Insurance

Life insurance policies help mitigate financial loss during difficult times. They also help check the mental stress resulting from such losses. Besides, they act as an important safety net for your family and help in generating savings that can be used in case of unforeseen events. However, it is important to read and understand your policy before buying one. This will ensure that you are aware of the benefits, exclusions and conditions that remove or limit coverage.

A Life Insurance policy helps secure the future of your loved ones by paying out a lump sum amount called Maturity Benefit in case of an unfortunate event such as death or disability. It is a contract between you and the Insurer (ICICI Prudential Life Insurance). You pay a premium for a specified period, which is known as the Policy Term, and in return, the Insurer promises to pay a Maturity Benefit at the end of the policy term. Depending on your needs, you can opt for Life Coverage, Maturity Option or a combination of both. You can also choose from a range of other options such as Simplified Issue or Guaranteed Issue plans that don’t require a medical exam.

Auto Insurance

An auto insurance policy protects drivers and passengers in the event of an accident. It also covers car repairs and the loss of vehicle value, known as Actual Cash Value (ACV). You can add optional coverage like personal accident cover or roadside assistance. You can also choose a deductible amount that fits your budget. A deductible is the amount you must pay before your insurance company begins to pay on a claim. Typically, higher deductibles lead to lower premiums.

Buying insurance is an important financial decision. But it’s often confusing, especially if you don’t know what the terms mean. The insurance industry uses lots of terms that can be hard to understand, like deductibles, limits, and exclusions. It’s important to take the time to read your policy so you understand what it covers and doesn’t cover, what your responsibilities are, and how to file a claim.

A policy is a legal contract between the insurer and the insured. In most cases, the insured is the person who purchases or pays for the policy. If the insured has questions about the policy, they should ask their agent or broker. It’s also a good idea to review your policy each year to make sure the coverage is still right for you. You can usually make changes to your policy any time, but you may have to pay for the change upfront.

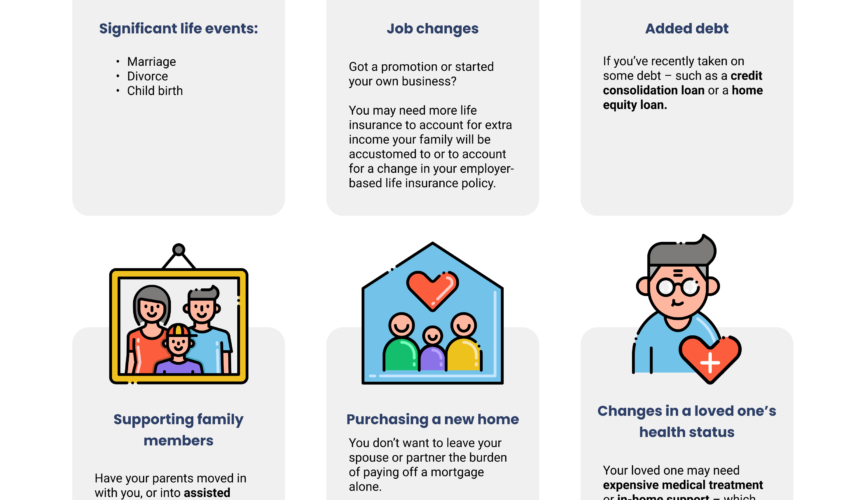

You should also let your agent or broker know if you change jobs, get married, buy or sell a car, or have any other major life events. This way, they can help you find new coverage that is the right fit for you. Always send any changes to your agent or broker in writing and keep a copy for yourself. It’s also a good idea send it via certified mail, return receipt requested to make sure it is received.

If you want to learn more about car insurance, click here. You can even find an online car insurance calculator to see how much your premium will be. You can also find tips on how to save money on car insurance and ways to increase your no-claim bonus.

Home Insurance

Everyone who owns a house or plans to buy one should have a good home insurance policy in place. It protects you from financial loss in the event of natural disasters like floods, earthquakes and fires. It also pays for the repairs or replacement of your personal property and structures. Homeowners should review their policies regularly to ensure they are adequately protected.

While the exact details of a policy can vary, most homeowners’ policies follow a similar format. Most have a Declarations section, which gives a summary of the policy and its cost, followed by a Description of Coverage section. The policy will also include a Definitions section that explains the meaning of terms used in the policy.

The policy will cover the damage to your home and its contents, and will often include other things that can be damaged or lost, such as fences, trees and shrubs; additional living expenses if you are forced to vacate your home because of a covered loss (hotel, food etc); and liability coverage in case a visitor is injured on your property. The policy may also cover the cost of removing debris from the site after a disaster.

There are many options for getting a good home insurance policy, and homeowners should shop around to find the best deal. Taking advantage of discounts like installing a home alarm system, bundling policies and being claims-free can also help lower your premium.

If you have a low credit score, it will affect your home insurance rates because it can signal that you are more likely to file a claim. If you can manage to raise your score, it will have a positive impact on your rates.

Insurance companies use a process called underwriting to determine whether they will sell you a policy and how much to charge. They look at your age, the condition of your home and its location to assess the risk that you will make a claim. They will also look at other factors, including previous claims made by you as a homeowner or other properties you own.